missoula property tax increase

Yearly median tax in Missoula County. Average Missoula County home 15 assessed value increase to 350000 for fiscal year 2022 140 increase in county portion of property taxes.

The report found that the average yearly increase in each homes property taxes from 2016 to 2020 were 74 8 and 65.

. The county is set to. What we choose to fund is a direct reflection of our values said commission Chair Josh Slotnick. There are other taxing jurisdiction that impact that total calculation including MCPS the city and statewide schools.

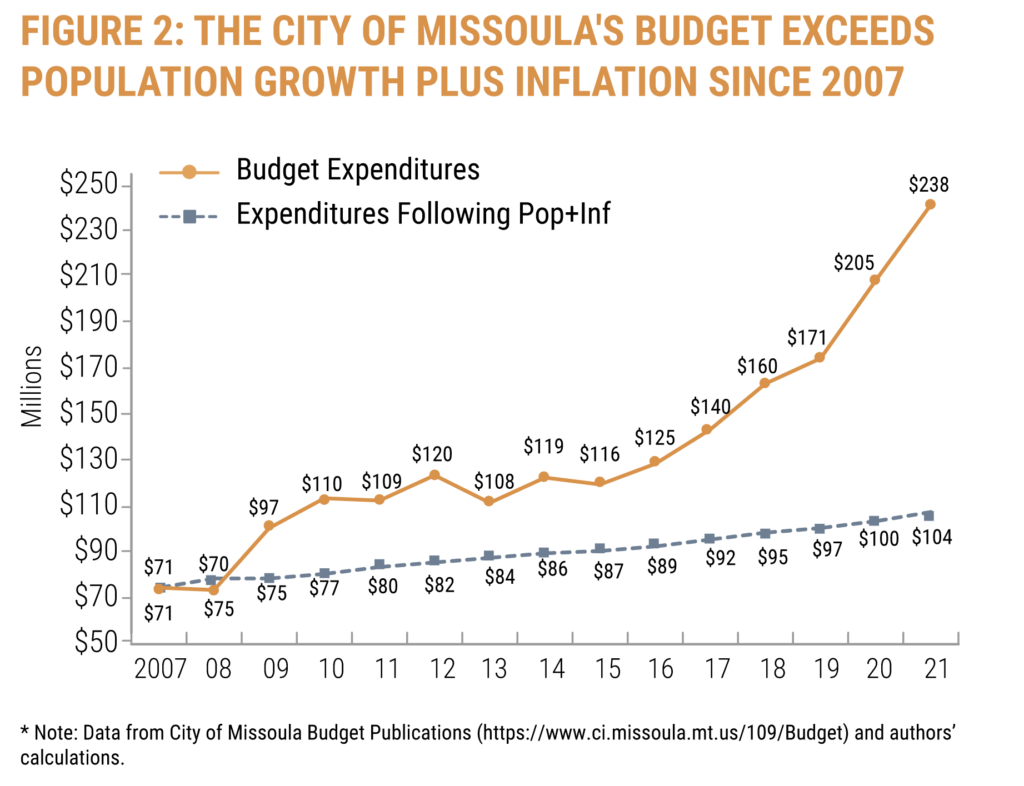

The Missoula City Council is expected to approve a 385-percent property tax increase at its Monday meeting. It happens in vibrant growing communities. Missoula County has one of the highest median property taxes in the United.

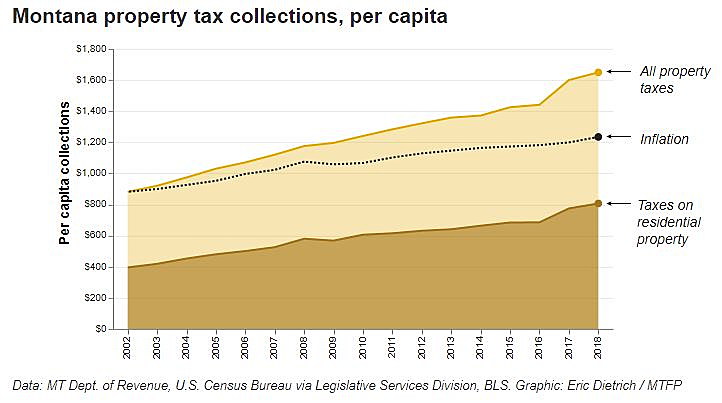

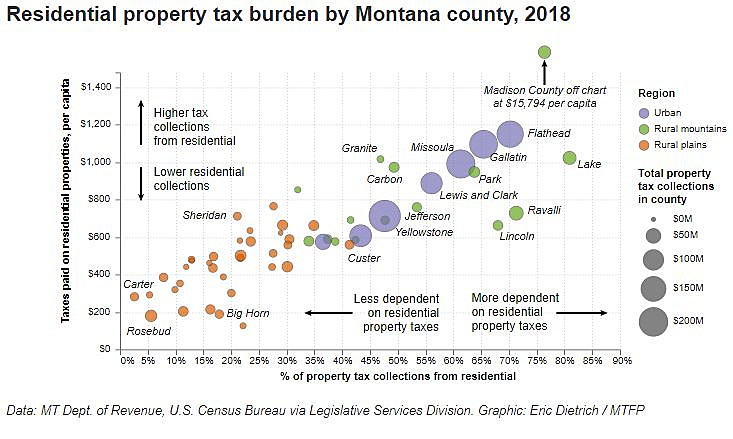

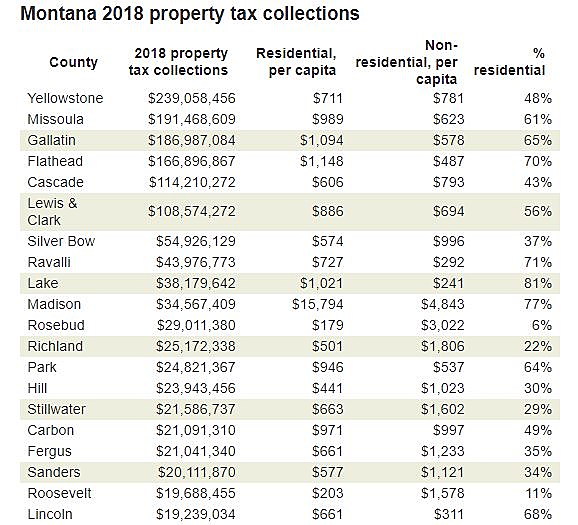

These increases are considerably higher than Montanas average yearly property tax increase of 5 and drastically higher than the national yearly property tax increase average of roughly 32. While it may seem small a few. Missoula mayor proposes property tax hike to pay for 385 percent increase in city spending EVE BYRON Aug 15 2018 Updated Nov 12 2021 0 Taxes on.

Missoula County collects on average 093 of a propertys assessed fair market value as property tax. Missoula County - Seeley Lake Office. The county is set to.

Partnership Health Center - Alder St. This fiscal year the average Missoula County reappraisal was 15 higher. That was taken into account during.

Montana Department of Revenue. The value of your property directly affects the property taxes you pay to schools Missoula County and the City of Missoula. If adopted as-is the preliminary budget would mean an estimated property tax increase of 1734 on a 350000 home or 145 a month.

Learn more about your appraisal notice and protest options from the Montana Department of Revenue. The median property tax in Missoula County Montana is 2176 per year for a home worth the median value of 233700. Montana Individual Income Tax Resources.

The accuracy of this data is not guaranteed. The Missoula City Council has approved a measure to boost its fees for parks and the services it provides to the specific groups who use the citys facilities. Under the new budget Missoula County residents with a 350000 home who live outside the city limits and only pay county taxes will pay an additional 1436 per year in property taxes and.

Read the detailed list of budget requests online or view the slideshow above. The countys budget for the 2021 fiscal year includes 1707 million in overall revenue with 544 million in property taxes. Missoula County Superintendent of Schools.

Its unfortunately caused a sharp rise in property taxes as well said Missoula realtor Brint Wahlberg. Our total taxable value increased 762 because the state of Montana property values increased. There are other taxing jurisdiction that impact that total calculation including MCPS the city and statewide schools Outside the reappraisal costs the budget adopted by the county will increase property taxes by 1021 for a 350000 home outside city limits.

This fiscal year the average Missoula County reappraisal was 15 higher. Missoula County - Seeley-Swan Search Rescue. 093 of home value.

And last updated 819 PM Sep 02 2019 Missoula County is proposing an 8 percent increase in property taxes to balance its new annual budget and its also calling on the state to fix what commissioners have deemed a broken tax system. Under the new budget Missoula County residents with a 350000 home who live outside the city limits and only pay county taxes will pay an additional 1436 per year in property taxes and homeowners within city limits with a home of. He said most homeowners saw a 15 to 20-percent increase.

The mayor announced the increase two weeks ago after announcing property valuations. TaxesAssess ments Road District Park District Non-Tax Revenues Fund Balance Transfer In Enterprise Revenues Tax Assessments Non-Tax Sources Proposed Revenues Mayors Funded New Requests Tax Scenarios FY 2022 CITY OF MISSOULA MONTANA City Council Funded Housing Community Development 1 Affordable Housing Trust Fund. Missoula County Weed District and Extension Office.

The Department of Revenue works hard to ensure we process everyones return as securely and quickly as possible. County Services City of Missoula home 0 overall increase for county services andvoter-approved bonds Missoula County home 1021 increase for county services and voter-approved bonds. Unfortunately it can take up to 90 days to issue your refund and we may need to ask you to verify your return.

Missoula County collects the highest property tax in Montana levying an average of 217600 093 of median home value yearly in property taxes while Wibaux County has the lowest property tax in the state collecting an average tax of 50500 084. Missoula County is proposing an 8 percent increase in property taxes to balance its new annual budget and its also calling on the state to fix what commissioners have deemed a broken tax system. Property Tax data was last updated 04112022 0700 PM.

During that period Missoulas tax base increased an average of 21 due to residents and businesses investing in renovating and building new buildings. You are visitor 4842626. Missoula County Road Building - Seeley Lake.

By Martin Kidston August 30 2019. The exact property tax levied depends on the county in Montana the property is located in. The notices for the 2019-2020 appraisal cycle are mailed in June 2019 with a 30-day protest period.

Missoula County Youth Court.

The Initiative That Could Upend Montana S Tax System Missoula Current

Missoula County Launches New Property Tax Allowance Aimed At Solar Panels Missoula Current

Missoula County Adopts Fy22 Budget State Reappraisals Lead To Property Tax Increase Missoula Current

Property Taxes Missoula County Blog

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

Property Taxes Missoula County Blog

Analysis Average Priced Missoula Homes Seeing Massive Property Tax Increases

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

Analysis Average Priced Missoula Homes Seeing Massive Property Tax Increases

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads Montana Free Press

Analysis Average Priced Missoula Homes Seeing Massive Property Tax Increases

Property Taxes Missoula County Blog

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

Analysis Average Priced Missoula Homes Seeing Massive Property Tax Increases

Property Taxes Missoula County Blog

Faqs Fy2021 Budget Engage Missoula

Proposed 2022 Initiative Would Cap Montana Property Taxes Assessment Values Missoula Current