after tax income calculator iowa

Many of Iowas 327 school districts levy an income surtax that is equal to a percentage of the Iowa taxes paid by residents. Tax March 2 2022 arnold.

1 200 After Tax Us 2022 Us Income Tax Calculator

The top marginal rate of 98 will remain in place until 2022.

. Compound Interest Calculator Present. Just enter the wages tax withholdings and other information required. It can also be used to help fill steps 3 and 4 of a W-4 form.

The Iowa Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Iowa State Income. Financial Facts About the US. The Iowa Income Taxes Estimator Lets You Calculate Your State Taxes For the Tax Year.

Appanoose County has an additional 1 local income tax. After Tax Income Calculator Iowa. After Tax Income Calculator Iowa.

The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month. The Federal or IRS Taxes Are Listed. 15 Tax Calculators.

So the tax year 2022 will start from July 01 2021 to June 30 2022. Your average tax rate is 1198 and your marginal tax rate is 22. If you make 55000 a year living in the region of Iowa USA you will be taxed 11457.

Your average tax rate is 1069 and your marginal tax rate is 22. Iowa Income Tax Calculator 2021. This places US on the 4th place out of.

If you make 70000 a year living in the region of Iowa USA you will be taxed 14177. Corporations in Iowa pay four different rates of income tax. Use ADPs Iowa Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

After Tax Income Calculator Iowa. Calculate your net income after taxes in Iowa. United States Italy France Spain United Kingdom Poland Czech Republic Hungary.

Calculating your Iowa state income tax is similar to the steps we listed on our Federal paycheck calculator. Tax March 2 2022 arnold. However the rates will be gradually reduced to meet the revenue.

If you make 62000 a year living in the region of Iowa USA you will be taxed 11734. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. That means that your net pay will be 43543 per year or 3629 per month.

Iowa Income Tax Calculator 2021. If you make 55000 a year living in the region of New York USA you will be taxed 11959. That means that your net pay will be 43041 per year or 3587 per month.

You can alter the salary example to illustrate a different filing status or show. After Tax Income Calculator Iowa. You can alter the salary example to illustrate a different filing status or show.

Calculate your Iowa net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Iowa paycheck. The Iowa Income Taxes Estimator.

Iowa Farm Income Tax Webinar 2020

2022 Iowa Farm Income Tax Webinar

Iowa Lawmakers Working To Eliminate State Taxes On Retirement Income

Cutting Taxes For All Iowans Office Of The Governor Of Iowa

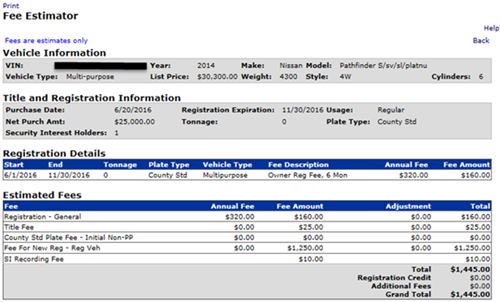

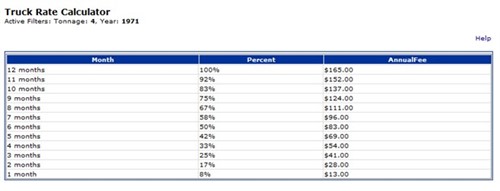

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Iowa Legislature Sends Significant Tax Bill To The Governor Center For Agricultural Law And Taxation

Iowa Paycheck Calculator Smartasset

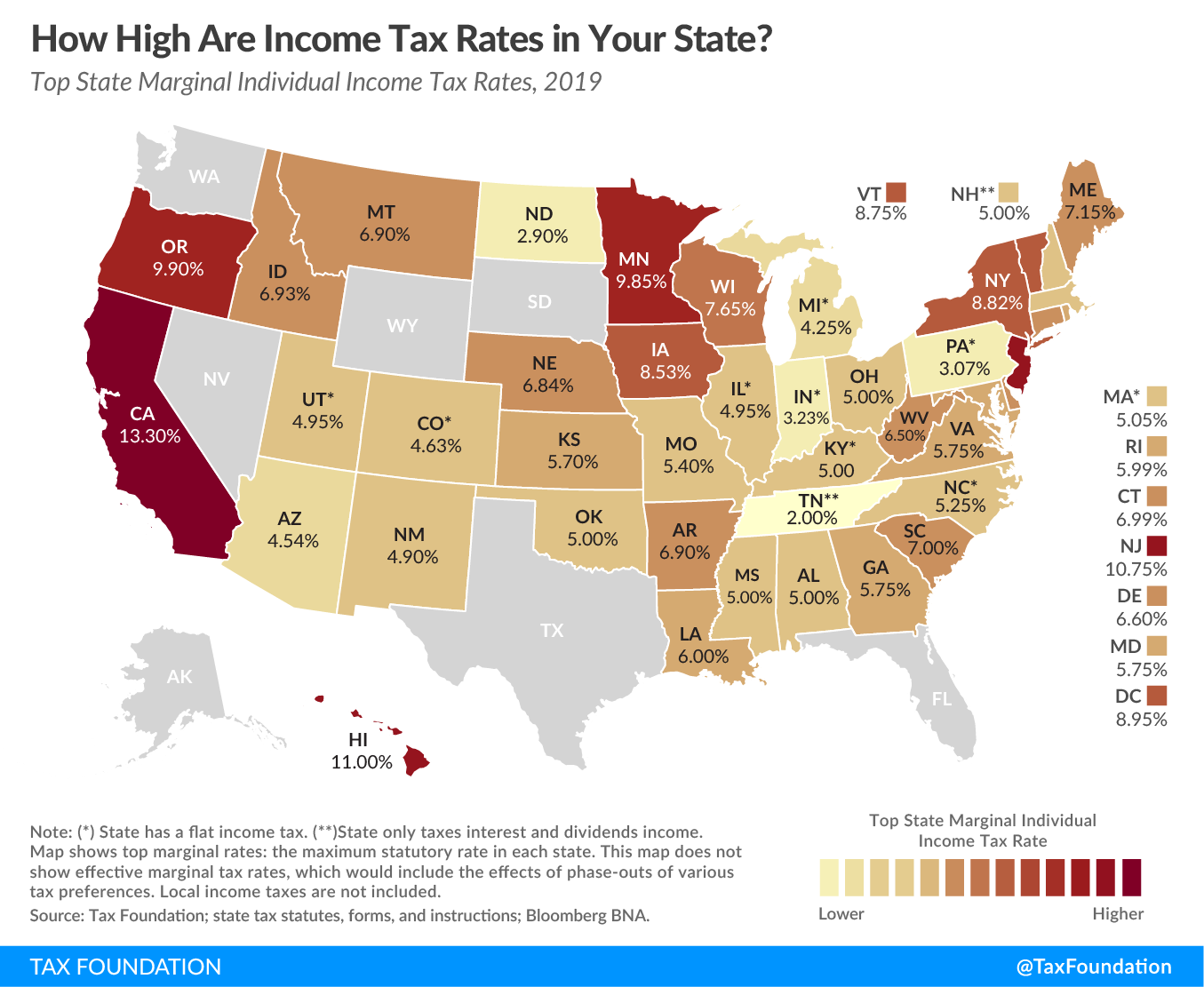

State Income Tax Rates Highest Lowest 2021 Changes

Iowa Retirement Tax Friendliness Smartasset

Car Tax By State Usa Manual Car Sales Tax Calculator

Iowa Salary Calculator 2022 Icalculator

Tax Calculator Estimate Your Income Tax For 2022 Free

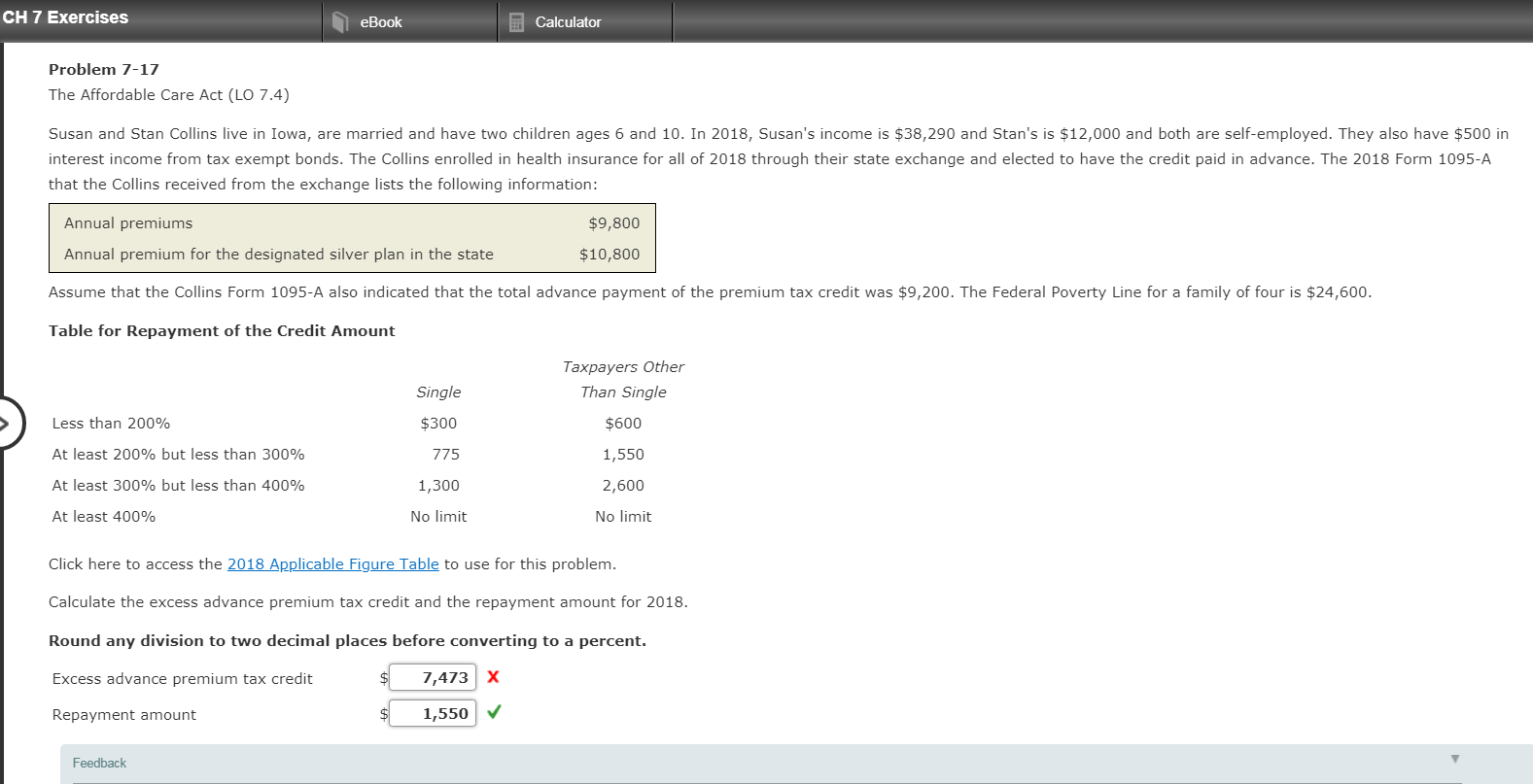

Ch 7 Exercises Ebook Calculator Problem 7 17 The Chegg Com

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Income Tax Calculator Estimate Your Taxes Forbes Advisor

State Individual Income Tax Rates And Brackets Tax Foundation

Car Tax By State Usa Manual Car Sales Tax Calculator

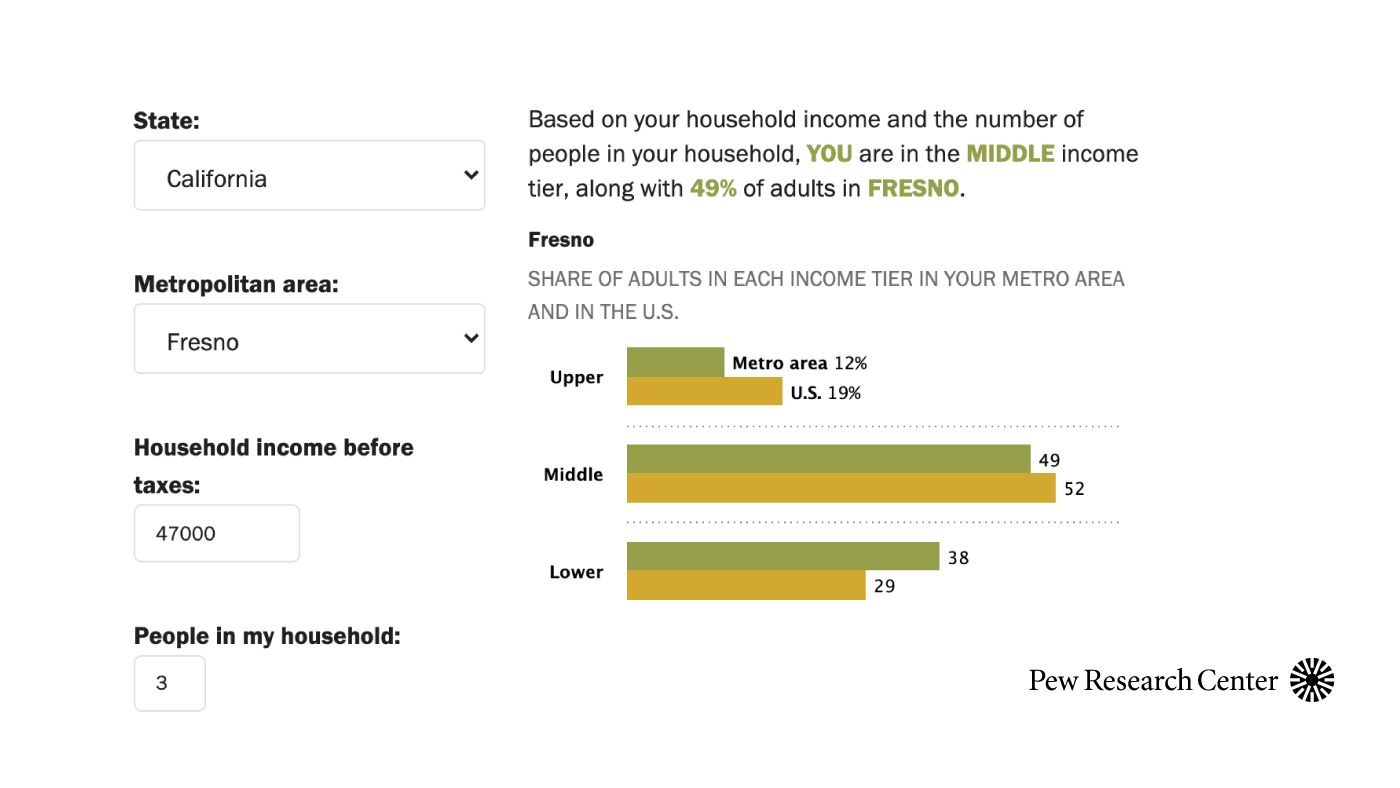

Are You In The U S Middle Class Try Our Income Calculator Pew Research Center

Tennessee 2022 Sales Tax Calculator Rate Lookup Tool Avalara